I break real estate into 8 categories. I learned these categories at my first COREE meeting in January 2017 from the COREE founder Vena Jones Cox. I highly recommend COREE and I now always start here with these categories when making personal real estate investment decisions. You should too!

1. Choose the Right Market and Location

You want to invest in real estate? Start by deciding which option fits best into your lifestyle, skill-set, tolerance for risk, and involvement. The current market conditions should support your decision. Also, you should be familiar with the location you choose. See below for the real estate options.

Tools

Use the categories below to direct your efforts.

2. Contractor

Contractors create value by building and get paid to do it.

Who does contracting: contractors can do the work themselves or hire it and be the project manager. Usually contractors have done the work they supervise and manage.

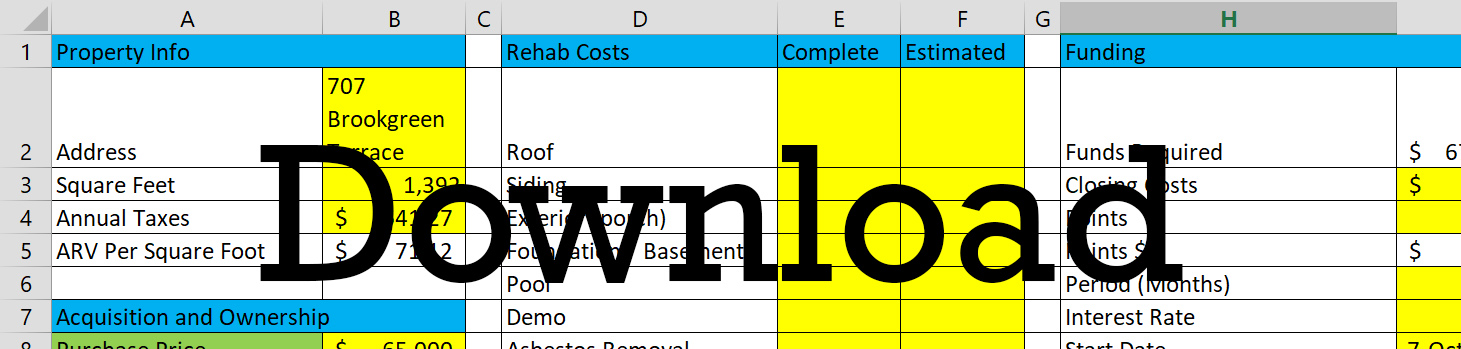

3. Rehabbing (buy, improve, sell, “flipping”)

Rehabbing is buying, adding value by improving, then selling. AKA “flipping.”

Who does rehabbing: rehabbing is generally best done by contractors, handymen, or people who are good at hiring contractors. It is very labor and capital intensive, but since you are adding value, can be lower risk.

4. Real Estate Agent

Real estate agents take a commission to help regular people and investors navigate the real estate market. We hold a license that requires us to uphold a fiduciary responsibility to our clients.

Tools

Either get your license, or know how to hire a real estate agent. See my referral program.

5. Wholesaling (find motivated sellers)

Wholesaling is finding motivated sellers and signing contracts to purchase for under-market prices, then selling the contract for a higher price, still under market value, to cash buyers.

Who does wholesaling: wholesaling often involves a lot of direct mail, and you have to have the stomach to drive people in a tough situation to as low a price as possible.*

*As a real estate agent, I do not wholesale.

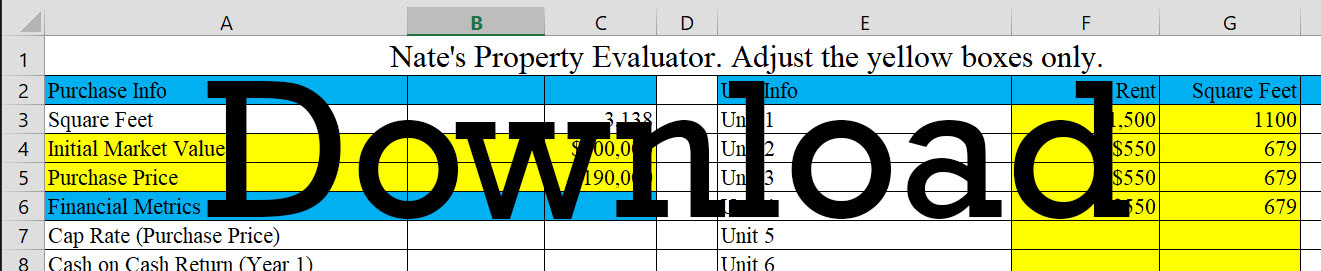

6. Landlording (self-managing or managing for hire)

Landlording is managing investment properties.

- Account for money.

- Select and manage tenants.

- Manage maintenance.

To manage for hire requires a real estate license and a broker with specific E&O insurance. Many brokers do not allow managing for hire. Many managers are brokers themselves. The broker license training revolves around accounting for money.

Who does landlording: managing is time, labor, and liability intensive. Very few people want to manage investment properties and deal with the “headaches.” For that reason, it is in high demand, and pays cash with little or no personal capital input.

Tools

When hiring a manager, I highly recommend finding a local manager who is part of IREM, the Institute of Real Estate Management.

7. Lease-Option / Rent-to-Own

This niche fills the gap between selling real estate and owning / renting out / managing real estate. Lease-options give a potential buyer with lower credit, usually in a small single family home, the chance to care for a home while leasing that he has the option to buy if he succeeds at obtaining financing. The advantage to the owner / investor / optionor is that the tenant takes on more maintenance responsibility and has personal buy-in.

Who this is for: this is a tool for investors in single family homes who want to transfer some of the maintenance responsibility to tenants and potentially sell some of their investments.

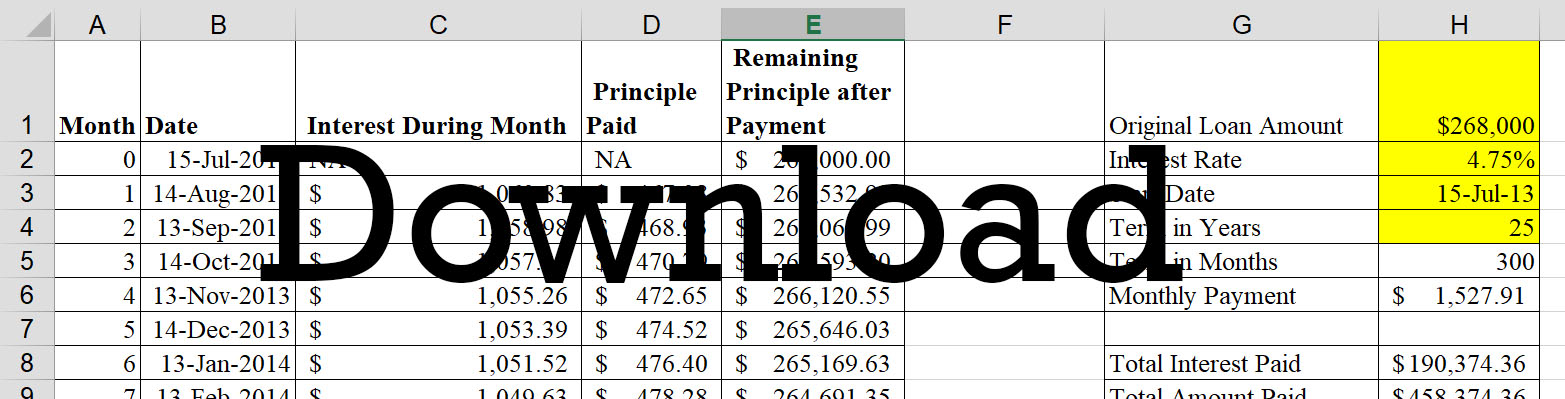

8. Be the Bank / Invest

This is where the money for any deal comes from. The guy with the money is taking a risk and deserves to be paid.

Who this is for: this is for people who have money and some experience choosing investments. Real estate can bring a high return, even very passive return, but when putting up your own money, you have to know your investment and trust the people managing it.