I wish I had this when I was taking piano lessons in Portuguese, so here it is in English. Enjoy!

English Lesson 7: How to Pronounce the Past Tense “-ed” Ending

Example sentences start at 1:46 in the video.

Here is the lesson that I made the video from, and a worksheet to practice:

English Lesson 6: How to Learn English at Home

- Pretend you already speak English.

- Learning language is not about information. It is about lack of information. Your brain has to want to learn. You are training your brain. Your brain has to be hungry for the knowledge.

- Watch television and movies you do not understand, and try to understand using only English. Use English subtitles, not your native language.

- Find English music you like and watch the lyrics videos on YouTube.

- Read books in English.

- Use an English-only dictionary.

- Your notebook should be English-only. No translation allowed. Find a way! Draw pictures, write words next to each other, or write entire English phrases to remember the definitions of words you are writing. It is easier to remember five words together than one by itself.

- Speak with friends. Who do you know who also wants to learn English? Watch the same movies, listen to the same songs, read the same books, and talk about them in English.

- We hear that babies learn languages rapidly. We assume it is easy for a baby to learn his language. It’s not easy even for a baby! The baby has to be hungry, he cries, he’s lonely for company, he’s embarrassed sometimes and frustrated… and therefore the baby’s brain finds a way to learn the language! Challenge your brain, and it will learn for you.

Great English Sources

- www.ted.com – has hundreds of interesting short speeches, all in English, with the transcripts and subtitles in many many languages including English.

- www.tedxesl.com – TED Talks specifically for learning English.

- www.youtube.com

- www.en.wikipedia.org

- www.eslflow.com

- www.breakingnewsenglish.com – has transcripts, very basic.

- http://www.telegraph.co.uk/news/worldnews/southamerica/brazil/

- http://www1.folha.uol.com.br/internacional/en/

Translating

- You will have to translate some to get the meaning sometimes. This is how to do that.

- Once you translate, repeat in English until you feel the meaning in English. Translating is necessary sometimes, but bad. Translating satisfies your brain too easily and you want a hungry brain.

Macro Photography from Brazil

These photos are from a back yard in the state of Pará, Brasil. Zoom in!

A Fly Takes Flight in 11 Photos

Ants

Flowers, Etc.

Mike Ryan’s Triboz

Meet Mike Ryan, and the Massa Trio Plays Triboz with Pictures, from my series Rio 2017 Made by Hand:

Triboz Rio Website

Mike Ryan’s Rio Art Orquestra Facebook Page

Click here for the Rio 2017 Made by Hand series.

Nate’s Favorite Things 2017

This is the fourth edition of my attempt to surpass Oprah in her dominance of the favorite things market. It is my most interesting list yet and includes a lot more of my friends. Check them out, support them, and Merry Christmas!

1. Jigisha Patel’s “Positive” T-shirts

Check out the Dot Not Shop with creative T-shirts and other great gear. Comment at the bottom with suggestions for Jigisha. My favorite .not gear that doesn’t exist yet is YourFace.not What .not shirt do you want to see next?

2. Libby Harris’ Book Box Club

My friend Graeme’s entrepreneurial daughter started this online book club for teens. It’s based in the UK, so it must be cool and of course they are the English experts. Get your high school age kids into something positive on the vast internet!

3. Katie’s Tru Man Brand

I met Katie of Tru Man Brand appropriately enough during an Ohio State football game. I had already seen her “OH So Good” T-shirts out and about so that makes her Columbus famous at least. Get a cool Ohio T-shirt this year that is designed a little off the beaten path from the usual Buckeye gear. Click here for the Tru Man Brand store.

4. Meet Cbus TV

OK, it isn’t even out yet, but Meet Cbus TV is coming in 2018 and it’s part mine, so of course it’s one of my favorite things. Subscribe, or buy a T-shirt (coming soon), to support our effort to put a camera on the most interesting people in Columbus!

5. Simple Kneads Gluten-Free Bread

They just keep growing and growing. Simple Kneads is in Whole Foods and expanding fast to a grocery near you. You can buy online while you wait for their arrival at the grocery.

6. Logitech Bluetooth Headset

If you talk on the phone, this product will change your life. This accessory is an absolute must-have.

- Wireless

- Hear conversation in both ears

- Hands-free

- Rechargeable with standard USB

- Quickly switch between computer and phone

7. NutriBullet

High quality and essential for getting a healthy breakfast on the run in those always-short morning hours.

8. What to Watch

There is so much alternative media out there, I decided to select the best-of-the-best to help curb those at-work and late-night “end of the internets” binges. Click here or on the TV and you’ll earn a history degree by accident:

The Challenge

Oprah has around 365 live audience members at her show. I’ll shoot for 365 hits to this page. Help me out and help the small businesses by sharing.

What to Watch Today

Click here for all What to Watch episodes.

I recommend by category in order by the tags below. Click a tag to select a category:

Ventures Update November 2017

695 Riverview Drive

I have been taking my own advice by improving what I have in lieu of buying more. Click here to see renovated apartment B4 available now.

We (my brother and I own this jointly) were contacted again with an offer to purchase. We shared stories with the prospective buyer about how we love our buildings, and turned the offer down.

Real Estate Agent

I went door-to-door in Clintonville and it was actually a very pleasant experience. It helped that there was nice weather and the people were nice, but also because I had something besides real estate to talk about. I was also pitching Meet Cbus TV:

Meet Cbus TV

I teamed up with videographer Matt DeNoble who is graduating from Ohio State this winter. We are going to do promotional videos for small businesses and have larger businesses sponsor them. The small businesses get free exposure. The large businesses get an authentic connection with the small business clientele, and the city of Columbus gets quality content from our own back yard!

Park City Holdings

I continue to adjust course on Park City Holdings. There is a huge opportunity. We need to tap it.

Kineomen

Kineomen’s founder has graduated from Duke Business School, so full steam ahead.

Simple Kneads Gluten-Free Bread

Simple Kneads is now available in 5+ Whole Foods stores in the North Carolina research triangle area and growing fast.

Vino de Coco

I still plan to visit the Philippines. Still.

Other

Art Gallery

Videos and Marketing

Local internet. Relevant advertising that people want to see, rather than trying to trick people for 5-30 seconds. Informative advertising. People are smart and getting smarter. Attention marketers! Trying to trick us just isn’t working anymore.

Hyperinflation … of Stuff

You may have heard of or remember from history class stories of “hyperinflation,” where the value of money drops to zero. Above are the most iconic images of this concept that I can think of. They are from the post-World War 1 German Weimar Republic.

How does this relate to us here today? How does it relate to real estate? Real estate is expensive. Space is at a premium. We have so much stuff that we can hardly fit it all in! In my first year in real estate, this has been one of the most striking surprises. My clients, who are moving, try to sell their things. Beautiful china cabinets and kitchen sets cannot find space on the floor of a consignment shop.

Sellers are happy if somebody can come pick them up and take them away. Working refrigerators on Craigslist have to be dropped to $20 or even free to get rid of them. I sold a nice desk and perfectly good adjustable rolling office chair for $30, but had to let the desk go by itself for $20 and I even delivered it for the buyer.

No space for the chair! I let it go for free so that somebody would come and get it. Consignment shops, re-purpose stores, and Goodwill are jam packed with stuff and there are more re-use stores popping up all the time. “New Uses” in Columbus is the latest one that I know of. There are three locations.

Have you been to the dump lately? It costs anywhere from $10-$50 and they are getting more and more picky about what they take. That’s right. Even the dump is picky about what they take. There are only a few dump locations who will take items with refrigerant (Sims in Delaware has the required equipment) and I have yet to find one that takes old fluorescent bulbs.

What to Do?

Trade in used goods. Use Craigslist. Garage sales have great stuff now. Check out this post here for several good options. Get a deal on the purchase, because you may find that selling actually costs you more money!

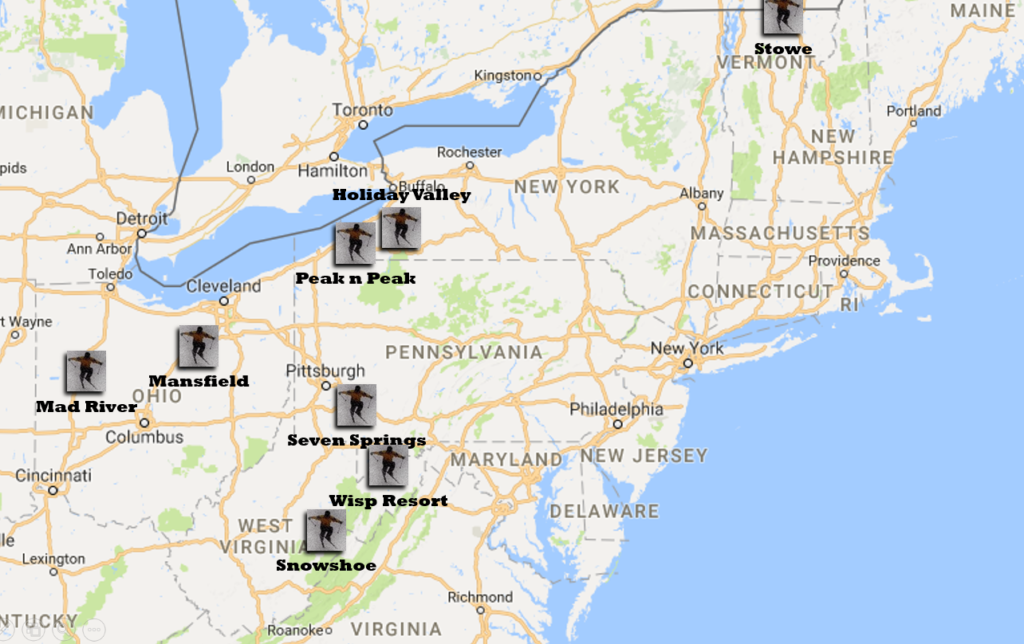

Our Favorite Ski Locations

Holiday Valley snow report

Ski Resorts

- Snowmass: 3,362 acres, 4,406ft vertical.

- Vail: 5,289 acres, 3,450ft vertical.

- Breckenridge: 2,908 acres, 3,398ft vertical.

- Beaver Creek: 1,815 acres, 3,340ft vertical.

- Keystone: 3,148 acres, 3,128ft vertical.

- Stowe: 485 acres, 2,360ft vertical.

- Snowshoe: 244 acres, 1,500ft vertical. Very difficult drive Greg says.

- Holiday Valley: 290 acres 750ft vertical.

- Seven Springs: 285 acres, 750ft vertical.

- Wisp Mountain: 132 acres, 700ft vertical. Greg and Pat have been. It is an easy drive from the interstate.

- Peak n Peak: 130 acres, 400ft vertical. Ed, Greg, and Thad have been. Good?

- Perfect North: 100 acres, 400ft vertical. Rachel’s suggestion. 45 minutes west of Cincinnati.

Check out OnTheSnow snow report app. Pat uses it for snow storm alerts.