All posts by Nathan Ruffing

Furniture Consignment Shops, Let’s Pop Some Tags, Columbus!

Consignment shops are a great place to buy and sell used furniture. Here’s how they work: somebody has a piece of furniture they want to sell, they bring it to the consignment shop and agree to allow it to be sold there for a commission to the consignment shop. The furniture sits on display at the shop until it sells and then the shop sends a check to the seller minus the commission. As time goes by and the furniture doesn’t sell, the shop lowers the price until it sells. This is usually done on an agreed-upon schedule.

It’s kind of like a full-time garage sale, or Craigslist with physical building.

So where should you go to “pop some tags” on furniture in Columbus? I have to defer to my mom on this one. My mom the expert says that the best consignment shops are:

Consignment Shops

- Grandview Mercantile Company in Grandview (no longer Short North)

- Experienced Possessions in Shawnee Hills

- Trading Places in Dublin

- One More Time, Etc. on 5th Ave. in Columbus

Government Surplus

During the pandemic OSU started selling through this site, and many other government entities dump valuable stuff here especially office furniture:

OSU Surplus

Of note also, Ohio State releases their surplus furniture once per month, click here for more info. There are some massive deals here and they also sell electronics.

The Goodwill

The Goodwill. You may not choose to buy a couch here, but you cannot rule out the Goodwill. I bought a floor lamp at the Goodwill yesterday and if I told you I paid $100, you’d believe me. Stainless steel, all three switches work, and I saved enough to put LED bulbs in it. Don’t feel bad either. Pay cash. You are creating jobs, and also helping people get rid of their old stuff. Win-win. Don’t believe me? Believe Wikipedia.

General Re-Use Stores

New Uses in Columbus is like Craigslist in person, or like an on-going garage sale with quality items. I highly recommend them. There are currently three locations near Columbus.

- New Uses, Sawmill Rd. and three other locations.

More Consignment Shops

- One More Time, Etc., West Fifth Ave.

- The Carpenter’s Daughter, West Fifth Ave.

- Fresco Furnishings, West Fifth Ave.

- Furniture Bank of Central Ohio, Franklinton

Craigslist, Etc.

I love craigslist and now offerup is similar.

How to Sell

- Take several pictures of each piece of furniture.

- Put all in one folder, and reduce the pictures to <1MB each.

- Write a short description with everything you know including manufacturer, age, original purchase price, condition.

- Each consignment shop’s site has a submission form or e-mail. They respond within a few days with a recommended price.

- They take a commission, usually 50%. With most you have to deliver the furniture, but some do pick-up.

Delaware to Columbus Bike Ride

1st of July 2017

There is an almost continuous dedicated bicycle path from downtown Delaware that reaches to downtown Columbus. Join me to enjoy this path on Saturday the 20th of May.

Leg 1

7:15 – Depart from Havener Park where there is easy parking, for Murphy Park in Powell. 8.0 miles.

Leg 2

8:15 – Depart Murphy Park for Antrim Park. 8.4 miles.

Leg 3 and Brunch

9:15 – Depart Antrim Park for Jack and Benny’s and the Blue Danube for brunch. 6.0 miles.

10:00 – brunch at Jack and Benny’s and / or the Blue Danube.

Leg 4 and Finish

11:00 – depart brunch for the last leg past Ohio State to downtown. 6.6 miles.

12:00 – finish at Scioto Audobon Metro Park for pick-up and shuttle back to Havener.

Total: 29.2 miles.

If rain, make-up day is Saturday the 8th.

Check back here for updates and ore details!

Comment below to tell me where you’ll be joining, or e-mail me at nate@nathanruffing.com

Personal Finance

Buying a home requires planning and preparation. The better prepared we are, the better deal we get from the bank, and the better deal we can get on a house. As a real estate agent, I see the benefits of financial planning (or disadvantage if lacking) with all of my clients! Financial planning = home ownership = financial planning!

Vineyard Columbus Financial Ministry

Vineyard Columbus church has excellent no pressure small groups to give you support in your path to financial freedom:

http://www.vineyardcolumbus.org/ministries/financial-ministry/about/

eFinPLAN (.com)

Kent Irwin is a friend of mine and a financial minister at Vineyard Columbus. He operates this reasonably-priced financial planning website here called eFinPlan. The important thing is to get a plan and stick to it!

Dave Ramsey

My 2 Cents: The Big Choices, and That’s It

In the end success comes from our own discipline, restraint, and choices. We know what to do. Doing it is the hard part. The small daily choices are the really difficult ones because we have to stay strong every day, day in and day out. Fortunately, there are three main decisions that really matter: easy credit, our car, and our house.

Cut up all but one credit card. Pay it off every month. If you can’t handle that, cut that card up and go all cash. Difficult, but simple.

Save for a car and only buy what you can actually pay cash for. Difficult, but simple.

Buy a house instead of rent, and buy one that you can afford. Take care of your house and your house will take care of you.

After these big choices, relax on the little ones. Go out to eat. Enjoy cable TV. Tip a little extra for those hard-working service job employees who are in the same struggle you are and help the next person out because your a financial winner now…

April Summary

Buyers, Get an Agent

Most homes for sale are listed on the MLS with a seller’s real estate agent. Most of those are listed under a contract called an “Exculsive Right to Sell,” with the seller’s agent and buyer’s agent commissions already agreed upon. That means that a buyer’s agent is already paid for if you buy the house, whether you have an agent or not. The seller pays for it from his proceeds. Make an agent earn that commission by working for you!

So where does the money go if you don’t have an agent? In that case, the seller’s agent usually is entitled to both sides of the commission.

Buy Linden

Click here to see available houses in Linden.

Are you a renter in Linden? This is for you. There is a good chance you are paying more in rent than you would pay monthly for a loan to buy a house.

When you own a house, you save money, and improve your neighborhood, while building equity. Equity is the amount of money your home is worth more than the amount of money remaining on your loan. Equity increases as you pay your loan.

The first step is to talk to a lender and fill out an application. It is worth the try!

These Lenders Want to Hear from You:

American Mortgage Service Company

American Eagle Mortgage in Columbus

- Ask about a 203K loan, which allows the buyer to borrow money to complete required maintenance.

Both of these lenders’ offices are close to Linden.

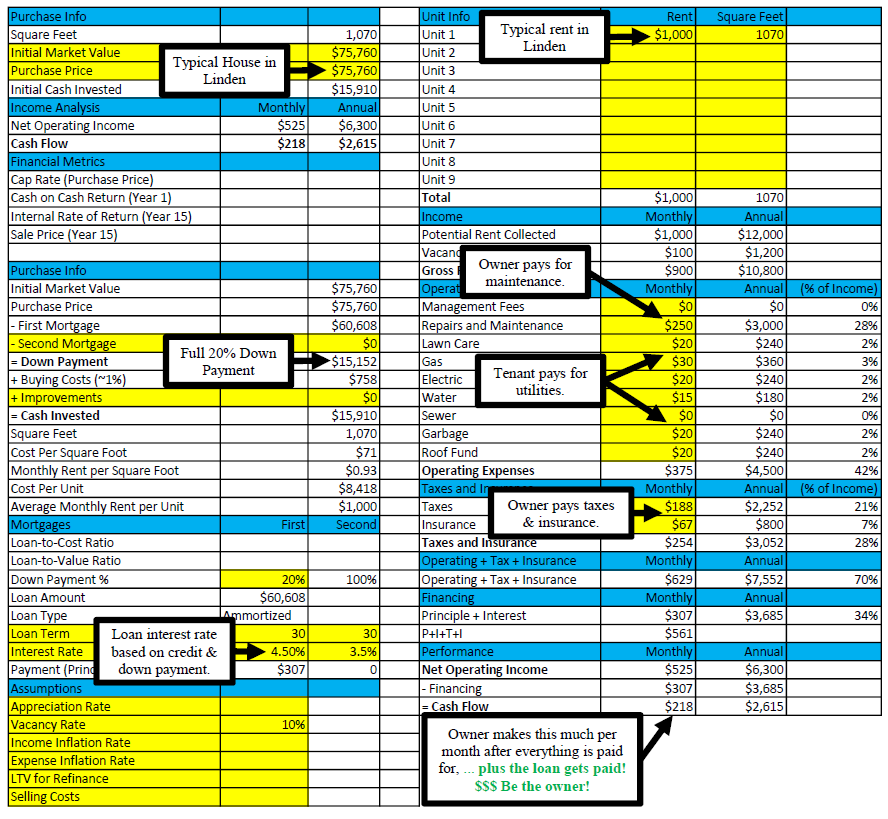

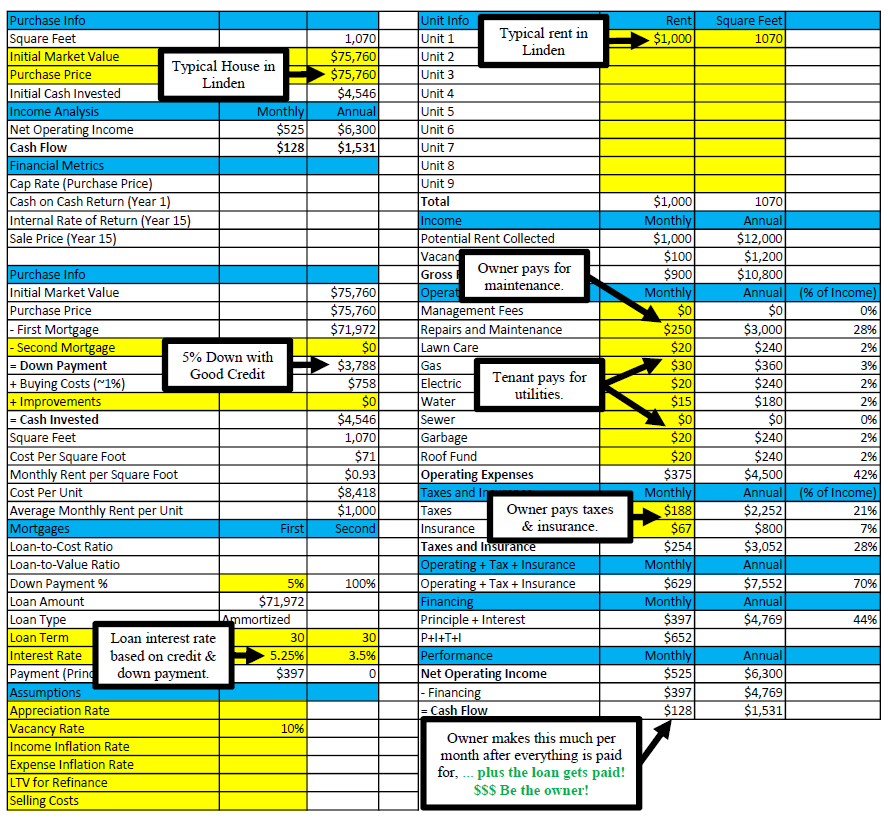

Below is a spreadsheet of the typical costs of operating a rental house in Linden. It shows that you are already paying enough … but you need to take credit for what you are paying by buying a house! If you either have minimum credit or can pay a 20% down payment, there is a chance you can own a home by just moving to another block or even by offering to buy the house you already live in.

Approximate With 20% Down Payment

5% Down Payment with Good Credit

Realtor® Registered Trademark Alt Code

Quick tip for Realtors®, you can quickly type the registered trademark “circle R” by holding the ALT button and typing 0174. This works on PCs.

ALT + 0174 = ®

ALT + 0153 = ™

ALT + 0169 = ©

Money

¥ = ALT + 0165

€ = ALT + 0128

£ = ALT + 0163

¢ = ALT + 0162

Math

¹ = ALT + 0185

² = ALT + 0178

³ = ALT + 0179

· = ALT + 250

° = ALT + 0176

¼, ½, ¾ = ALT + 0188, 0189, 0190 respectively.

√ = ALT + 251

π = ALT + 227

https://www.keynotesupport.com/internet/special-characters-greek-letters-symbols.shtml

Foreign Languages

ñ = ALT + 0241

? = ALT + 063

¿ = ALT + 168

Just search “alt code … ” for more.

Buyers, Get an Assumable Mortgage Loan

You should ask your lender about an assumable loan. This means that if you sell your house in the future, you can pass the loan to a qualified buyer. Typically, FHA loans are assumable.

The market conditions are great to buy a house right now. Interest rates have risen a little, but can still rise a lot more. If you have an assumable loan, you have the option to offer a qualified buyer today’s market conditions by giving them your low-rate mortgage along with your house.

An assumable loan can make your home easier to sell with more buyers and at a higher price in the future.

More information here:

http://www.bankrate.com/finance/mortgages/assumable-mortgage.aspx

Open Houses!

Not doing anything Saturday? Sunday? Try these easy searches to see a list of all the open houses coming up this weekend:

Open Houses Franklin County All