I wrote a post called Big Money almost 2 years ago in January 2014. This is a follow-up to that post to update the numbers.

$18.1 trillion = annual US gross domestic product estimate (www.BEA.gov)

$3.2 trillion = US government tax revenue, fiscal year 2015 estimated (http://www.gpo.gov, Fiscal Year 2016, Historical Tables, Table 2.1)

$18.7 trillion = US government national debt as of today (www.treasurydirect.gov)

$0.40 trillion = interest expense on US government outstanding debt, fiscal year 2015 (www.treasurydirect.gov)

0.40 / 18.7 = 2.1% average annual interest rate on the national debt

0.40 / 3.2 = 12%, interest expense as a percentage of tax revenue

$3.53 trillion = currency exchange reserves held by the Chinese government as of Oct 2015 (www.tradingeconomics.com) This has been steadily decreasing since it peaked at $3.99 trillion in mid-2014.

$4.25 trillion = money supply inflation as of Nov 2015 by the practice of quantitative easing (www.federalreserve.gov with data interpretation help by Wikipedia) This amount has been relatively steady since Oct 2014.

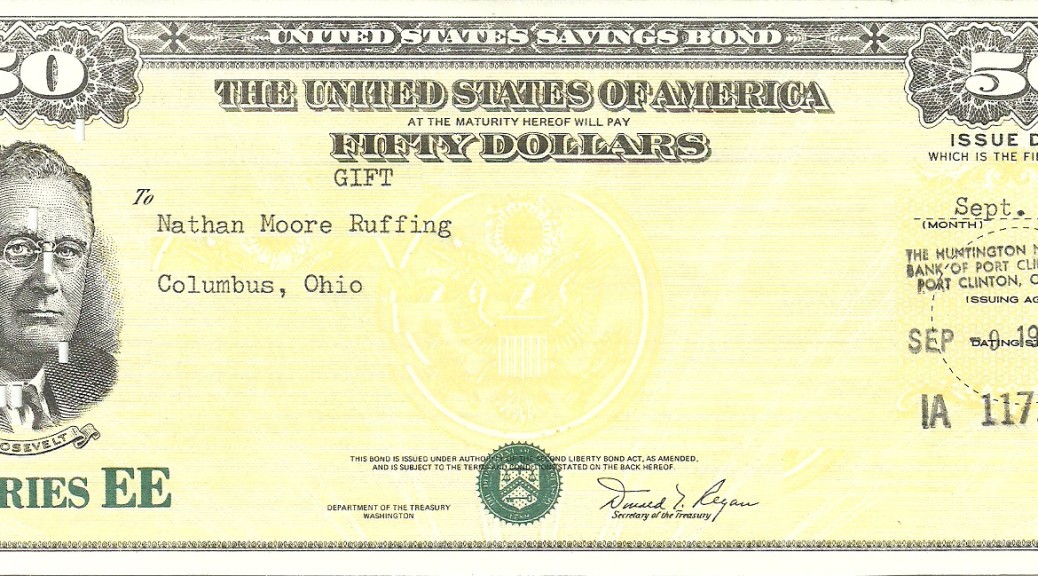

All of the US government numbers come directly from balance sheets available on .gov sites. It was calming to find the numbers I’ve heard about in the news on a regular old balance sheet. I don’t think I will rush to cash in my savings bond.

Nathan,

Happy Thanksgiving! I feel it is important to note that the Chinese debt dumping acted as a reverse quantitative easing (QE) for that $0.5T making our QE effect 12% less.

Secondly, our current borrowing costs are historic lows. Would our nation, like any household, be foolish not to borrow money in biblical proportions right now to implement some long term money saving programs? Infrastructure is a fine example of something that could absorb the endless amount of money we need to borrow to make it significant. Infrastructure is also government run or so highly regulated that it is in essence.

An obvious counterpoint is that debt is more expensive in the long run and we should actually pay for what we do rather than allowing an infinite false force to exist in all world markets and in our spending decisions. I would counter by agreeing but reminding the point maker that ship has sailed. If we are not going to balance the budget and pay off the debt we must go the opposite direction faster than any other nation. In the debt game you are either issuing new debt and doing what is in your best interest or you are paying other countries for what you’ve already done.

The shame is that other countrymen are working real hard lives to make our goods. Their governments are buying our debt to make more home currency so their prices stay low enough to keep selling us goods. We use the debt to keep our real life styles relaxing and to purchase actual hard assets like the ones they made. They get dollars and exchange them for home currency, increasing the demand and therefore value. In the long run this would be good but the powers that be won’t stay if their society matures and has growing pains like loss of manufacturing etc. The biggest growing pain is that, not linearly, at a certain price the US would stop purchasing their goods and choose to purchase from another country. This would cause massive layoffs. So they do as aforementioned and buy more US debt. They need us to want their goods and as long as one nation will work to make goods for the US then any trying to mature and get out of the debt wheel will face the near term massive layoffs and restructuring of society.

There is one way for a nation to escape and mature while making goods for the US. They can disband their own currency and use dollars. So far this has never happened.

Sincerely,

Buckminster Montgomery

The right thing to do is to pay for what we do. You said it best at dinner. That forces us to prioritize, choose what we pay for, and tell some people “No, we can’t afford it.”